Driving Financial Growth Through Digital Marketing Excellence

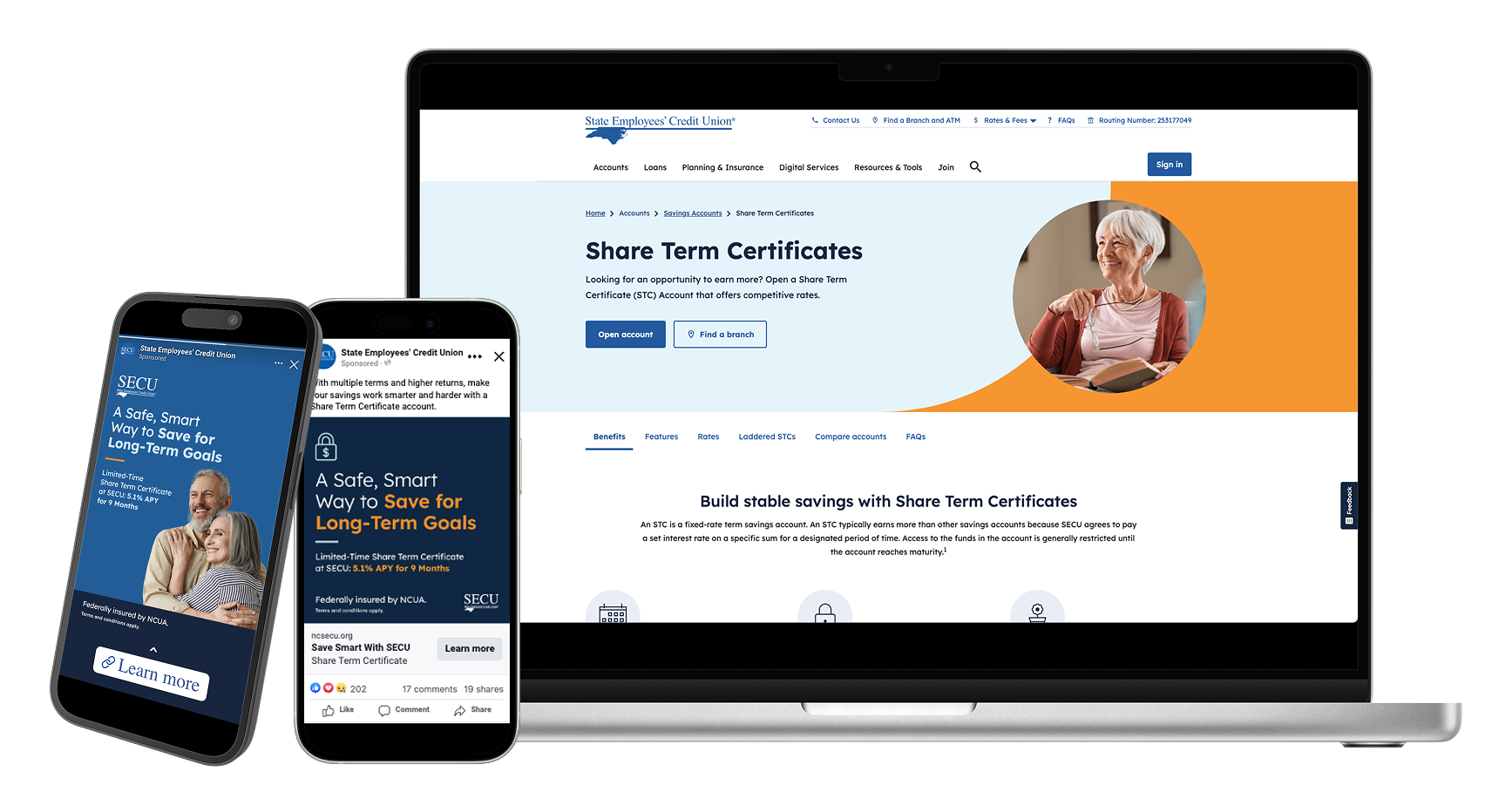

Walk West was tasked with executing a highly successful digital marketing campaign that generated $3.2 billion in portfolio growth while maintaining strict data privacy standards. By leveraging search engine marketing, social media advertising, and programmatic advertising without relying on first-party CRM data, SECU achieved remarkable engagement rates and cost efficiencies while expanding their customer base and deposit volumes.

How We Got Started

SECU (State Employees’ Credit Union), the nation’s second-largest, state-chartered credit union, serves over 2.8M members with $55B in assets. Recognizing the evolving digital landscape, SECU aimed to enhance its digital marketing strategies to drive membership growth and deepen member engagement. With the help of Walk West, they were able to achieve:

CTR above industry benchmark

CPC below benchmarks

increase in website sessions

STC portfolio growth during the campaign

The Challenge

SECU faced a critical business challenge: how to drive growth in applications and short-term certificate (STC) deposits while adhering to rigorous data privacy policies that prohibited the use of member CRM lists. This limitation created a unique marketing obstacle, as the campaign needed to effectively target both current and prospective members without utilizing traditional first-party data sources.

The stakes were high, as SECU needed to enhance its market position while maintaining its reputation for member privacy and security. This careful balancing act required innovative approaches to audience identification and targeting that would preserve member trust while delivering meaningful business results across multiple financial product categories.

- Acquire New Customers: Identify and convert qualified prospects into SECU members

- Increase Existing Business: Encourage current members to expand their relationship with additional products

- Maintain Privacy Standards: Achieve business goals while upholding stringent data protection policies

The Strategic Approach

Walk West implemented a comprehensive, multi-channel digital marketing strategy designed to maximize reach while maintaining targeting precision. The approach leveraged various complementary channels and innovative data solutions to overcome the limitations of traditional first-party targeting.

Search Engine Marketing

The campaign deployed sophisticated SEM tactics to capture high-intent users actively searching for financial products and services. Keyword strategies were developed to target both branded terms for existing member awareness and non-branded financial product terms to attract prospects considering similar offerings from competitors.

- Targeted high-intent financial keywords

- Optimized ad copy for different audience segments

- Implemented advanced bid strategies for efficiency

Walk West utilized platform-specific targeting capabilities across major social networks to reach both current and potential members with engaging, visually compelling creative assets. Custom audiences were built using interest-based and behavioral signals that indicated financial service needs without requiring member-specific data.

- Deployed platform-native targeting solutions

- Created segment-specific messaging variations

- Utilized video and carousel formats for engagement

The campaign leveraged sophisticated programmatic buying capabilities to reach precisely defined audience segments across thousands of websites, mobile apps, and digital channels. This approach enabled broad reach while maintaining targeting accuracy through algorithmic optimization and real-time bidding strategies.

- Facilitated continuous campaign optimization

- Automatically shifting budget toward the highest-performing audience segments

- Consistent creative executions

- Placements to maximize efficiency and conversion rates throughout the campaign period

Third-Party Data Integration

To overcome the limitations of first-party data restrictions, SECU partnered with specialized data providers to identify both current credit union members and individuals eligible for membership. This innovative approach enabled targeted messaging without compromising customer privacy or violating internal policies.

The third-party data strategy included careful compliance reviews to ensure all targeting methodologies adhered to financial industry regulations and SECU's internal privacy standards, creating a responsible framework for audience identification.

The Key Takeaways and Business Impact

These impressive metrics reflect not only the campaign's ability to drive awareness and engagement but also its success in converting that interest into tangible ROI. The $3.2 billion in STC portfolio growth represents a substantial return on marketing investment while strengthening SECU's market position. Key takeaways:

Privacy-Compliant Marketing Excellence

The campaign demonstrates that financial institutions can achieve remarkable marketing results while maintaining the highest standards of customer data privacy. By developing innovative targeting approaches that don't rely on first-party data, SECU created a blueprint for responsible digital marketing in highly regulated industries.

Multi-Channel Integration Benefits

Walk West utilized platform-specific targeting capabilities across major social networks to reach both current and potential members with engaging, visually compelling creative assets. Custom audiences were built using interest-based and behavioral signals that indicated financial service needs without requiring member-specific data.

Data Strategy Innovation

The creative application of third-party data sources proved that effective targeting doesn't require compromising customer privacy. This approach offers a valuable model for other financial institutions facing similar challenges with first-party data limitations.

Conclusion

Walk West's strategic investment in digital marketing transformed SECU’s ability to attract and engage members. By leveraging targeted content, SEO, and personalized communication, SECU not only enhanced its digital presence but also achieved measurable growth in membership and financial performance. This case exemplifies how credit unions can effectively compete in the digital age through thoughtful and data-driven marketing strategies.